The Best FRM® Courses in Lebanon

Want to get complete information about the FRM® Courses in Lebanon? Here are useful insight to read carefully!

The Financial Risk Manager (FRM®) Certificate is administered and issued by the Global Association for Risk Professionals (GARP).

The FRM® Certificate has been adopted by companies as a benchmark to ensure their risk management employees are well versed in the latest financial risk concepts. The Certificate identifies risk professionals that are qualified to provide competent advice based on globally accepted industry standards and who are committed to personal professional development and ensures that they possess the body of knowledge necessary for independent risk management analysis and decision making.

Like other careers in finance, having an advanced degree and certification helps to increase your career potential in financial risk management. FRM® holders occupy positions such as Chief Risk Officer, Senior Risk Analyst, Head of Operational Risk, and Investment Risk Manager, to name a few. If you are in financial risk management or considering a career in it, then earning your FRM® is the next natural step.

A strong understanding of strategic risk disciplines has become essential in today’s ever-changing marketplace. Expand your knowledge and comprehension of the financial risk concepts and set yourself apart from your competition.

Become recognized globally as a leader in financial risk management. The FRM Program has seen dramatic growth in global acceptance and experienced a compound annual growth rate of 29% in total registrants in the last 8 years. Grow your networking connections and join the elite group of over 24,000 global FRM Certificate holders.

Boost your credibility and respect from employers, peers, and clients and maximize your personal and professional opportunities within the world of finance.

Employers around the world realize that the FRM Program prepares candidates with the specialized knowledge and skills necessary to succeed in the dynamic financial services industry. The FRM designation is by far the best known and most respected designation for financial risk, with 46 of the top 50 banks in the world (by total assets) having a significant presence of Certified FRMs.

Mastering the concepts underlying risk management in today’s dynamic market environment will give you a holistic view of risk management. By preparing for the FRM Exam, you will gain state-of-the-art knowledge that is useful on the job every day, because the Exam is designed and updated twice a year by some of the world’s leading risk professionals to reflect current marketplace issues. 92% of those who sat for the May 2011 FRM Exam would recommend that their colleagues also sit for the FRM Exam.

The FRM certification provides you with a lifelong platform to network with some of the world’s most prominent financial risk management professionals, expanding your professional opportunities within the world of finance. More than 26,000 individuals from 110 countries and territories across the globe have passed the FRM Exam, so you will become part of an elite group. Certified FRMs value the designation, with 82% preferring to hire a job candidate with the FRM designation over one without.

Mastering the content of the FRM Exam and completing the many hours of self-study represents a significant commitment to the risk management profession, positioning you as a leader in the field and signifying your commitment to professional excellence.

Real-world experience is an essential component of attaining FRM certification. No other financial risk designation requires candidates to demonstrate related professional experience — so becoming a Certified FRM means considerably more than passing an exam.

All Certified FRMs are expected to adhere to principles that promote the highest levels of ethical conduct and disclosure beyond following the letter of applicable rules and regulations. Employers know that Certified FRMs will help safeguard their firms’ reputations.

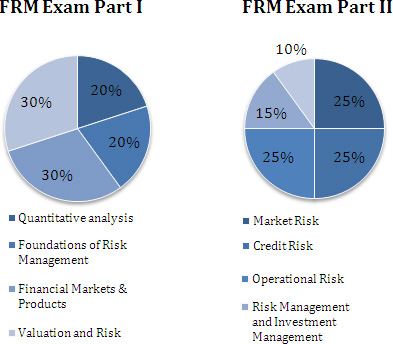

The FRM Part I curriculum covers the tools used to assess financial risk: quantitative analysis, fundamental risk management concepts, financial markets and products, and valuation and risk models.

The FRM Exam Part II focuses on the application of the tools acquired in Part I through a deeper dive into market, credit, operational and integrated risk management, investment management as well as current market issues.

Who can enroll in the FRM® program?

The FRM® program is suitable for undergraduates (senior college students), graduates and Master’s levels. Each year over 350 different educational institutions worldwide are represented by FRM candidates.

Certificate Requirements

In order to be certified as a Financial Risk Manager (FRM®) and be able to use the FRM® acronym after your name, the following is required:

• A passing score on the FRM® Examination (on each of the two levels of the certificate).

• Active membership in the Global Association of Risk Professionals (GARP).

• A minimum of two years experience in the area of financial risk management or another related field including, but not limited to, trading, portfolio management, academic or industry research, economics, auditing, risk consulting, and/or risk technology.

Earning the right to use ‘FRM®’ after your name, demonstrates professionalism and dedication to the profession.

FRM self-study program include

| Any Schweser study package | ||

| Exam entrance ticket/registration |

FRM open course study program with IFA includes:

| Full and rigorous live study classes grouped in 4 modules (62 hours) taught by our top-notch faculty that would collectively cover all the topics of the level. | ||

| A complete package of study material including outlines of the readings and solutions. | ||

| The original SCHWESER Review material and preparation notes that comprehensively cover all study sessions of the program. | ||

| Self assessment exams. | ||

| Mock exam (full day to simulate the “big” day). | ||

| Schweser Pro QBank (over 500 online practice questions & solutions) |

Original tuition: please contact our program coordinators for open class tuitions.

Eight reasons for choosing IFA’s in-house courses versus self-studying alone

1. Benefit from the highly competent IFA instructors.

2. Benefit from several years of experience tutoring hundreds of students.

3. Attend classes in state of the art classrooms at IFA premises.

4. Get self assessment exams prepared exclusively by IFA.

5. Get 1 full mock exam simulating the real FRM official examination.

6. Benefit from a large network of professionals.

7. Benefit from unlimited online and offline technical support.

8. Benefit from the IFA Career Boost service for better job and business opportunities.

PremiumPlus™ Package

To best prepare for the FRM® exam, get the most complete study package available. Learn the curriculum through our concise study materials. Practice with sample questions and full-length practice exams. Retain critical information with our Final Review Workshop and enter the test center with confidence!

Premium Instruction Package

Add structure to your study plan while increasing your comprehension of the FRM® curriculum topics. The Premium Instruction Package allows you to get connected to expert instruction through real-time, interactive webcasts. You also receive complementary study tools that instill the critical topics covered in class.

Essential Self-Study Package

The Essential Self-Study Package brings clarity and focus, as well as flexibility and efficiency, to your FRM® exam preparation. With the help of Schweser Study Notes and our easy-to-use online tools, you can master the difficult FRM curriculum at a faster pace.

Final Review Pack

Finish strong with the Final Review Pack — the ideal way to wrap up your study plan. Review the key concepts and receive exam tips just before you take the exam! The Final Review Pack is designed for late-season review.

Exam Fees & Deadlines

The FRM Exams are offered on the third Saturday in May and the third Saturday in November. The 2019 schedule of important registration dates and fees is provided below:

FRM Program enrollment and exam Registration Fees

|

FRM |

May 18, 2019 |

November 16, 2019 |

|

|

Program Enrollment Fee |

USD 300.00 | Valid for 4 Years* | Valid for 4 Years* |

|

Exam Fee |

If you register between these dates: |

||

|

Exam Early Registration** |

USD 350.00 | Dec 1, 2018—Jan 31, 2019 | May 1, 2019—Jul 31, 2019 |

|

Exam Standard Registration** |

USD 475.00 | Feb 1, 2019—Feb 28, 2019 | Aug 1, 2019—Aug 31, 2019 |

|

Exam Late Registration** |

USD 650.00 | Mar 1, 2019—Apr 15, 2019 | Sep 1, 2019—Oct 15, 2019 |

**Fees per FRM Part I and II (Returning & FRM Part II Candidates only pay the Exam FEE)

The Global Association of Risk Professionals (GARP) is a not-for-profit organization and is the only globally recognized membership association for risk managers. GARP’s goal is to help create a culture of risk awareness within organizations, from entry level to board level. In the areas of financial and energy risk management, GARP sets the global standard in professional designation with the FRM® (Financial Risk Manager) and ERP® (Energy Risk Professional) certifications. Through trusted education and training, media, and events, GARP promotes best practices in risk management and supports ongoing professional and career development for risk managers.

To Register for the FRM® Exam please follow the below link:

www.garp.org/frm/register.aspx

For more information about the Financial Risk Manager – FRM® designation, please check GARP’s websitewww.garp.org

For details about the 2022 Schedule, please contact us

00961-1-366535 or 00961-3-647350

info@ifamena.com or layal.elsabeh@ifamena.com